M&A Monday: The Importance of the Step Up

While an obscure topic, the Step Up has huge economic consequences on a buyer.

One of the most overlooked, but impactful structure considerations for a buyer is the step up. This is often determined in the early stages of a deal at the LOI phase or immediately after. Not focusing on achieving a step up could cost a buyer millions of dollars.

In this post, I will discuss structuring an M&A deal, so if you have not read my first post on structure, go back and read it: Asset vs. Stock/Merger https://x.com/Eli_Albrecht/status/1751969230856028400.

What is the Step Up?

The tax adjustment of the book value of the target company's assets to their current market value at the time of the purchase.

This allows the buyer to reset the value of the target’s assets to the market value regardless of the depreciation and amortization the seller already took.

All of this only impacts what happens in the tax universe. The reality is the assets are worth no more and no less than they are.

What are the benefits of a Step Up for Buyer?

Increased Depreciation after Closing. Because the assets will be stepped up to market, the buyer will be able to restart the asset’s depreciation schedule, depreciate more of the asset after closing, and thus reduce taxable income.

Lower taxes upon a sale. If the stepped-up assets are sold in the future, the higher basis will reduce capital gains tax.

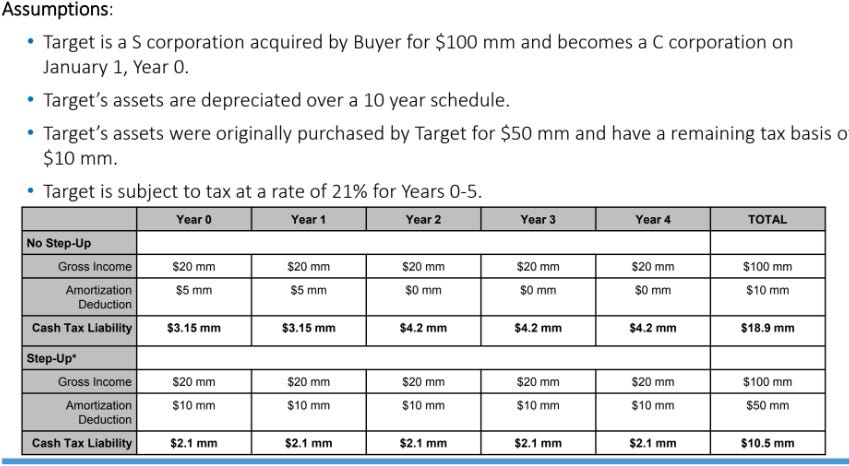

Here is an illustrative example of the benefit of a step up in a transaction:

How to achieve the step up?

A step up will only be achieved on an asset purchase or deemed asset purchase (not a stock purchase without further action (see below). Thus, the buyer wants to structure the transaction as an asset purchase in the first instance. However, if there are impediments to doing so (i.e., contracts or licenses that cannot be assigned), the transaction will have to be structured as a stock purchase that is deemed as an asset purchase for tax purposes. This is done through a 338(H)(10)/338(g) election or an F-Reorg (Asset vs. Stock/Merger https://x.com/Eli_Albrecht/status/1751969230856028400).

In a regular stock/membership interest purchase, the buyer steps into the shoes of the seller. Meaning, the assets will have the same tax value the seller attributed to the asset and whatever remaining depreciation the seller currently has. Because the purchase price has to be spread out among the business’s assets (allocated), the assets are going to be more valuable than prior to closing.

Adverse Tax Impacts on Seller.

There could be a range of negative tax impacts on the seller. I won’t do a deep dive into these, but know that the seller may have (a) higher taxable gain (because of the higher value of the assets), (b) some ordinary income gain rather than capital gains (depending on the situation), (c) depreciation recapture – if seller previously took accelerated depreciation deduction on those assets, that depreciation will be recaptured, (d) double taxation in a C-corp – in an asset sale a C-corp pays taxes on the asset sale and then on the gain distribution to stockholders, whereas in a stock sale, there is a single level of tax, and (e) alternative minimum tax could be triggered.

Thus, as a buyer, make sure that this is negotiated at the LOI stage and insist that the seller diligences their tax situation. I have had more than a few deals go off the rails because the seller realized how much tax they are paying and how little money they would actually take home.

The Gross-Up.

Over the past decade in a hot seller’s market, PE groups began offering a “gross up” to the seller. The “gross up” is an amount of money representing the tax impact to seller of structuring a deal as an asset purchase (achieving a step up for Buyer) and if the deal had been done as a stock purchase. For example, if the asset purchase will cost the seller $1m in additional tax liability, the buyer pays that as an addition to the purchase price to make seller tax neutral. The gross-up is less common on smaller deals. It is not rational to pay sellers for a tax gain they already benefited from (through accelerated depreciation), however, this is simply an economic point of negotiation.

Ultimately, the gain the buyer will get from the step-up will far exceed the gross-up amount.

The gross-up amount will have to be calculated by seller’s CPA and diligence by buyer.

The takeaway on this post should be, step ups are very important. Make sure you have a competent M&A lawyer who is looking out for this early on.