M&A Monday: Timeline of an Acquisition. Weighing Simultaneous vs. Sign Then Close

Chapter 2: An overview of the M&A process (Part 1)

Newer sponsors and searchers often have confusion over the timeline of an acquisition, time to closing, different options for simultaneous or non-simultaneous signing and closing, how many days of exclusivity, and which service partners you need in each phase (covered in a prior M&A Monday HERE)

Similarly, on a seller’s mind is, how long will this take? What is the process? Can this buyer get to closing quickly? Reasonably so. A seller will have to run their business while balancing the difficulty of an M&A transaction. A seller also wants to know the buyer is knowledgeable enough to close the deal.

Buyer should evidence this in the LOI and early discussions with Seller. When I am on pre-LOI calls with the seller, I will say something like, we expect this transaction will take 60-90 days, however, it will be 20 days of intensive diligence production, then leading up to the purchase agreement signing will be intense, but between signing and closing we will be focused on transition plans.

You should be able to walk the seller through simultaneous vs. non-simultaneous signings and closing and why you are choosing one or the other. This post will give you the talking points you need.

Last week after my client’s offer was accepted by the seller, I ran into the seller's broker on another deal. I asked him, I know our offer was not the highest, why did we win the deal? The broker said, your buyer had a good, clear grasp of the process, the higher offer could not articulate a clear timeline to closing and we did not feel confident he could get to closing.

There are five phases in acquiring a business: (1) Search Phase; (2) LOI submission (3) Post-LOI to purchase agreement signing; (4) purchase agreement signing to closing (5) Post-Closing.

1. Search Phase. The Sponsor searches for a target. You sign NDAs (best practice to form an LLC to sign your NDAs), speak to brokers, filter website listings, execute off-market strategies, and start underwriting deals that you like (I will do a deeper dive into search strategies in a future post). During this phase, you may have initial conversations with the broker or seller. Check out these posts, Gameplan for Initial Seller/Broker Call, and Every Offer begins with Seller.

This phase can take a few months to 18 months. Some sponsors search while balancing a full-time job and others dedicate themselves to the search. During this phase you may look at hundreds of targets.

2. LOI Phase. After the Sponsor has received financials and enough information to formulate a valuation and deal structure, it is time to draft and submit an LOI. This is when clients usually reach out to me or another M&A lawyer for guidance. (A future chapter will do a deep dive into drafting the LOI). The LOI includes non-binding provisions and certain binding provisions, including exclusivity. Exclusivity gives the buyer between 45-90 days during which time seller may not negotiate with any other buyers. Closing timeline should be included in the LOI.

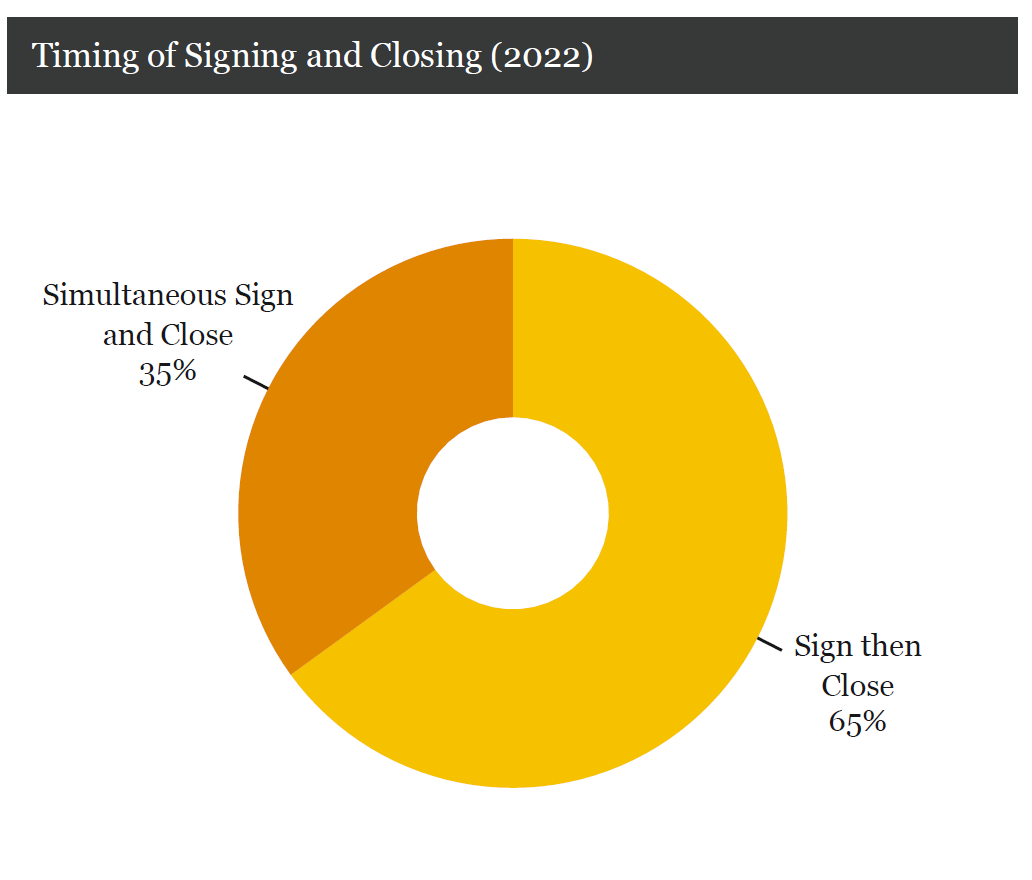

Simultaneous vs. Sign Then Close. At this point, we have a choice:

a. Simultaneous Sign and Close (SSC). We could sign the purchase agreement and all other documents at the Closing. Doing this requires buyer do all due diligence, quality of earnings, legal workstreams, financing workstreams (often including deposit), third-party consents, permit transfers, and employee offer letters while only under LOI. Essentially, the seller could wait out exclusivity and walk away resulting in the buyer losing time and deal costs.

b. Non-Simultaneous Sign and Close (NSSC) or Sign Then Close. In the non-simultaneous scenario, the purchase agreement is signed and form of exhibits are agreed upon soon after signing the LOI. Then Closing occurs at a later date when closing conditions are met (Closing Conditions Explainer).

If you opt for NSSC, you should include this in your LOI and be ready to speak to the pros and cons.

Once the LOI is signed, a Sponsor will kick off financial diligence/quality of earnings, legal diligence, drafting (customarily, buyer drafts) the purchase agreement and ancillary documents (i.e., promissory note, rollover agreement, bill of sale, assignment of IP, assignment and assumption, etc.).

In an NSSC, once the terms of the purchase agreement and other documents are agreed upon, the purchase agreement can be signed (even if diligence is ongoing). Signing the purchase agreement extends Exclusivity until Closing, and commits the buyer and seller to close on those terms assuming no material adverse effect or inability to complete a Closing Condition.

Traditionally, NSSC is used for when certain time-consuming actions have to be taken before closing, including antitrust approval, consents from customers, suppliers, landlords, or foreign governments, and bank financing requiring a signed purchase agreement.

In an SSC, signing of the purchase agreement and all other documents occur at the same time as Closing.

I am a strong advocate for NSSC. Here are the pros and cons for buyer:

Pros:

i. Exclusivity only needs to last until the purchase agreement is signed, because the PA extends exclusivity.

ii. Differ more expensive items for after signing the purchase agreement (e.g., finance deposit, negotiating investor term sheets, more costly diligence such as, environmental).

iii. Gives time to obtain third-party consents, permits, or other approvals.

iv. Some banks require a signed purchase agreement prior to entering underwriting.

v. Security of knowing that terms have been negotiated and seller cannot back out of the agreement.

vi. Negotiating a purchase agreement early is way more collaborative. Trying to finalize a purchase agreement after 90 days of an M&A process is not pleasant.

Cons:

i. Buyer is also locked into Closing, unless closing conditions are not met (so pay attention to the closing conditions).

ii. Changing terms upon discovery of new information will require an amendment to the PA.

iii. In reality, the recourse for seller breaching the purchase agreement is to sue the seller for specific performance to force seller to closing. This is often not cost effective.

While, traditionally, a NSSC is viewed as pro-buyer, I prefer NSSC for sellers as well. I think it makes the process smoother and as long as closing conditions are tight and an outside date is well-defined, the seller should feel comfortable with a NSSC.

This was Part 1 covering steps (1) Search Phase; (2) LOI submission (3) Post-LOI to purchase agreement signing.

Part 2 will cover steps: (4) purchase agreement signing to closing, and (5) Post-Closing.