M&A Monday: Transaction Structures: Asset vs. Equity Acquisition

A threshold issue in the LOI: how to structure an acquisition.

There are 3 primary ways to acquire a company: (1) Equity Acquisition, (2) Asset Acquisition, and (3) Merger.

(1) Equity Acquisition (Equity P). Buyer acquires the equity (stock for a corporation, membership interests for an LLC) of the target company. This allows the Buyer to step into the shoes of the prior owner.

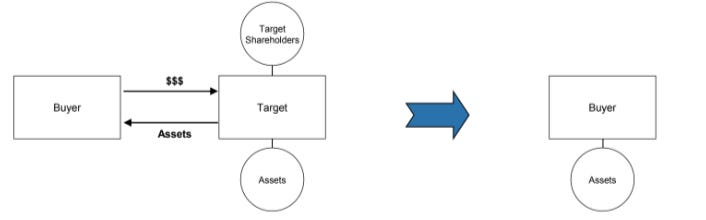

(2) Asset Acquisition (Asset P). Buyers acquire all of the target’s assets and assign them all to buyer’s new entity. The prior target entity is usually a shell, left with only the assets or liabilities not taken by buyer.

(3) Merger. There are multiple types of mergers (Direct, Reverse Triangular, Forward Subsidiary Merger). Mergers are a statutory combination of entities. The new entity is the successor to all the prior entity’s rights, obligations, and liabilities.

A buyer’s LOI should specify the preferred structure. To determine this, you need to weigh the below factors.

Then, post-LOI, make sure the lawyers have a kick-off meeting (with requisite tax folks) to confirm structure. It is frustrating, but not uncommon for the structure to change throughout the deal.

Usually, the most beneficial structure for an independent sponsor/searcher buyer is the Asset P.

However, sometimes an Equity P is necessary. Mergers are rarely required on smaller deals so I will not address them in this post.

Consideration for your structure:

A. Assignment vs. Change of Control. The most common driver of structure are assignment issues. In an Asset P, each contract of the target must be assigned to buyer’s new entity. Sometimes the target has a ton of contracts with anti-assignment language.

Importantly, an Asset P will trigger anti-assignment language (e.g., no assignment without the consent of counterparty) and change of control restrictions (e.g., no change of more than 50% of ownership without consent of counterparty). Property leases are almost never assignable and often hang up an asset deal (unfortunately, often an Equity P still requires landlord consent).

Permits will also have to be assigned, although rarely is this allowed. Sometimes (rarely), debt can be assumed in an Equity P.

Thus, sometimes the volume of consents and approvals (e.g., government contracts) that have to be obtained from external third-parties necessitates an Equity P.

A handful of consents from third-parties are normal and usually manageable.

Note: if a contract is silent on assignment, in most jurisdictions, assignment is allowed.

B. Tax impact. This is complicated and I will do a deeper dive on this in a future post. Usually, from a tax perspective, Buyer prefers an Asset P. or “deemed asset purchase” and sellers prefer an equity acquisition. For the Buyer, an Asset P or “deemed asset purchase” gives the buyer a valuable “step up” in the tax basis.

This means Buyer acquires a tax basis equal to purchase price + assumed liabilities (as opposed to target’s historical tax basis in assets). This allows Buyer to take more depreciation and amortization deductions and reduce taxable gain on a later sale. Here is an example of the significance of a “step up” benefit:

Sellers may have increased tax liabilities as a result. This can be because seller gets taxed at the entity and shareholder level and sometimes because of additional incremental tax on “751 hot assets”. Sometimes, seller gets buyer to pay a “gross up” (an increase in purchase price) equal to seller's increased tax liability. This is rare on small deals, but very common on middle-market PE deals.

A “deemed asset sale” can be achieved even when doing an Equity P by purchasing all interests in a single member LLC or partnership, making a 338(h)(10) or 336(e) election, or doing an F-Reorg. An Equity P + deemed asset acquisition does not trigger assignment issues and an F-Reorg even keeps the target's same EIN.

C. Liabilities and Choosing Assets.

When doing an Equity P, the buyer steps into the target owner’s shoes. That means, buyer acquires all the assets and liabilities of the business (even for periods prior to closing).

An Asset P, allows the buyer to cherry pick the assets and some or none of the liabilities. It also leaves *most* legacy liabilities behind (in rare cases, legacy liabilities carry over (e.g., environmental, ERISA, some litigation)).

Choosing an Equity P requires a deeper due diligence dive and usually larger indemnification recourse (e.g., escrow, promissory note, holdback – see past M&A Monday for a dive on indemnification recourse:

https://twitter.com/Eli_Albrecht/status/1663537389824876545?s=20).

D. Approvals. The seller or target’s board must approve the transaction. If there are a few owners this is not an issue. However, if many owners and some resist a sale, we may want to use one structure over another. This is the primary driver of using a merger structure.

Note: when submitting an LOI, make sure all sellers sign that LOI. There are many sad stories that produced this tip. When the seller says, don’t worry about Jimmy, he’ll come around when he sees the money, be very worried about Jimmy.

E. Transition Items. Sometimes it is just administratively easier to do an Equity P. In an asset purchase, all employees are terminated and rehired by buyer sometimes triggering PTO obligations, benefit plans have to be assigned, insurance has to be repurchased, leases assigned, bank accounts transferred, and debt paid off. Some of this is prevented in an Equity P.

SBA 7(a) Note. An SBA lender will lend on most acquisition structures, however, if doing a partial change in ownership, the structure has to be an Equity P.

I have started a new M&A Mondays Newsletter (which will include more than just Monday). Subscribe below!