M&A Monday: What and Who Must Stand Behind the Representations & Warranties.

Do not make the mistake that this buyer made.

Last week, I reviewed an old purchase agreement for a new client. He is an independent sponsor and we are representing him on a larger deal now. He asked us to review a purchase agreement from a prior deal because he believed there was a misrepresentation. After closing, he found out the seller knew a key customer was planning to leave and the seller did not tell us.

The client asked, Eli what can I do?

I reviewed the purchase agreement and, yes, there was a misrepresentation in the material contracts section. Then, I moved to the Indemnification section. Good news, the client was indemnified for breaches of reps with no limitation on survival, no caps, and no baskets (this was a small deal). Finally, I looked at the first sentence of the Indemnification section and it said, “Seller will indemnify…”

Bad news.

In an asset sale, Seller was the entity that sold the assets to buyer. It had long been dissolved and even if it existed it is a shell with no assets. I flipped to the signature page hoping the owner had signed in their individual capacity, but no, only the seller entity.

Bad news.

There was a promissory note, but no right to offset. There was no indemnification holdback, escrow, rep and warranty insurance, or owner indemnity.

In an M&A acquisition the reps, warranties, and indemnifications are only as good as what is standing behind those reps and warranties. As a reminder, reps and warranties are promises a seller is making about their business, that if untrue and cause a loss, the buyer can recover for those losses (see, Representations and Warranties, What If Something Goes Wrong After Closing: https://x.com/Eli_Albrecht/status/1734314621102669994).

However, the seller entity in an asset purchase will be an assetless shell after closing. It will likely dissolve and claiming an indemnification against that entity will be useless.

Thus, on every deal, a buyer has to ask themselves, if something goes wrong, who and what is standing behind the indemnifications.

It can be an escrow, holdback, promissory note, rep and warranty insurance, and/or the seller, personally. Let’s briefly deal with each.

1. Holdback. Buyer holds back a portion of the purchase price to cover indemnifications. This is best for buyer because they bring less to closing and it is an interest free loan. Most importantly, the money is in the buyer’s possession and therefore in buyer’s control. If the buyer says there is an indemnification and refuses to pay the holdback, seller will have to weigh the amount against the legal costs of pursuing such amounts.

2. Promissory Note. While this has other advantages for a buyer’s cap stack (See: Getting a Seller Comfortable with a Promissory Note: https://x.com/Eli_Albrecht/status/1767304931923349648 and the Forgivable Seller Note: https://x.com/Eli_Albrecht/status/1724081900803731800), the note can be used to “offset” indemnifications. Meaning, if there is a loss after closing, the buyer can decrease the note for such amounts. Again, the control is with the buyer and if the seller disputes, they have to spend money enforcing it against the buyer. The major downside is this does not put money in the buyer’s pocket to pay for an out-of-pocket loss.

3. Escrow. This is when a portion of the purchase price is put in an escrow account and if there are indemnifications, those are claimed against the escrow account. This is a great option for buyers because they can recover real money and for sellers because no money is released if they dispute the loss. The control is with a third party.

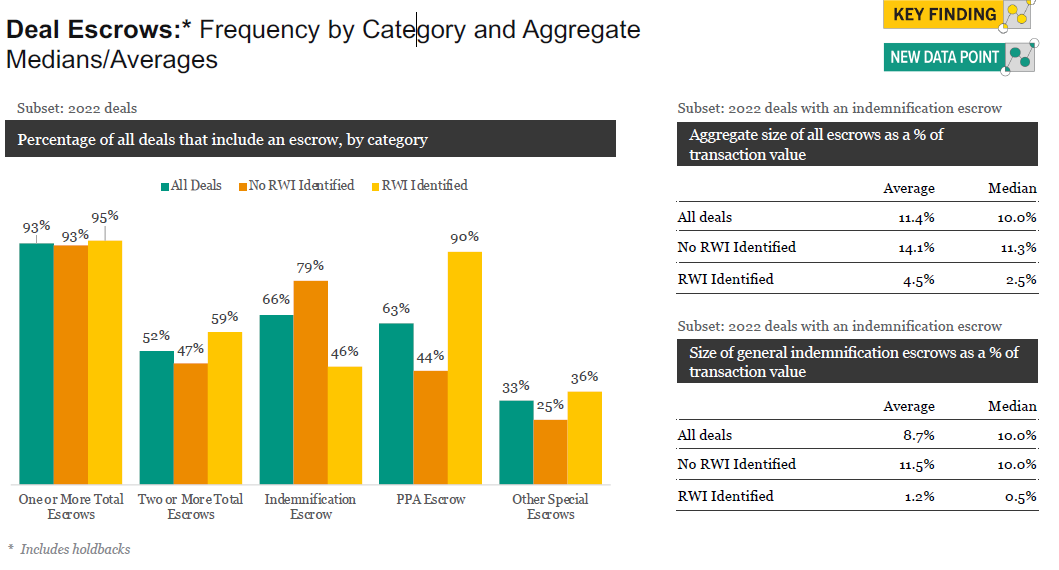

The following graph shows data on how frequently escrows are used in middle market deals:

The following chart shows how large an escrow tends to be (if there is an escrow present):

4. Rep and Warranty Insurance (RWI). This sounds great, in theory. This is when an insurance company agrees to stand behind the reps and warranties of a seller. Theoretically, if there is a misrepresentation, buyer can simply file a claim and get paid.

Like any insurance company, their job is not to pay the claim. First, they require in-depth diligence to be done by the buyer prior to closing. Second, they carve out any known issues, fraud, or willful misrepresentation. Finally, if you make a claim they will try their best to find a reason not to pay it.

Also, this relieves the seller of their responsibility to be thorough and truthful in their disclosures because they rely on insurance standing behind their promises. I like sellers to feel they have some skin in the game after closing.

5. Owner indemnification. In all cases, after the above methods are exhausted it is best for owners to stand behind the reps and warranties, personally. Owners will throw up their arms and claim this runs counter to the Great American Ideals of limited personal liability.

This is wrong.

In reality, owners have received the full purchase price payment and must return part of it if they misrepresented something about their business. Just like if one receives soup with a fly floating in it, they can return the soup for a refund. Owners should not have a right to keep money they made through misrepresentations.

However, especially in the private equity world, this is a non-starter. Very few shareholders of a seller will agree to this. Thus, we need to rely on #1-#4 to stand behind the reps and warranties.

Hopefully, this M&A Monday will prevent you from making the mistake that my client made in his prior deal.